Undervalued & Overlooked: Micro-Cap Stocks with Massive Potential

Market Overview

Resilient market remains near all time highs

Legal

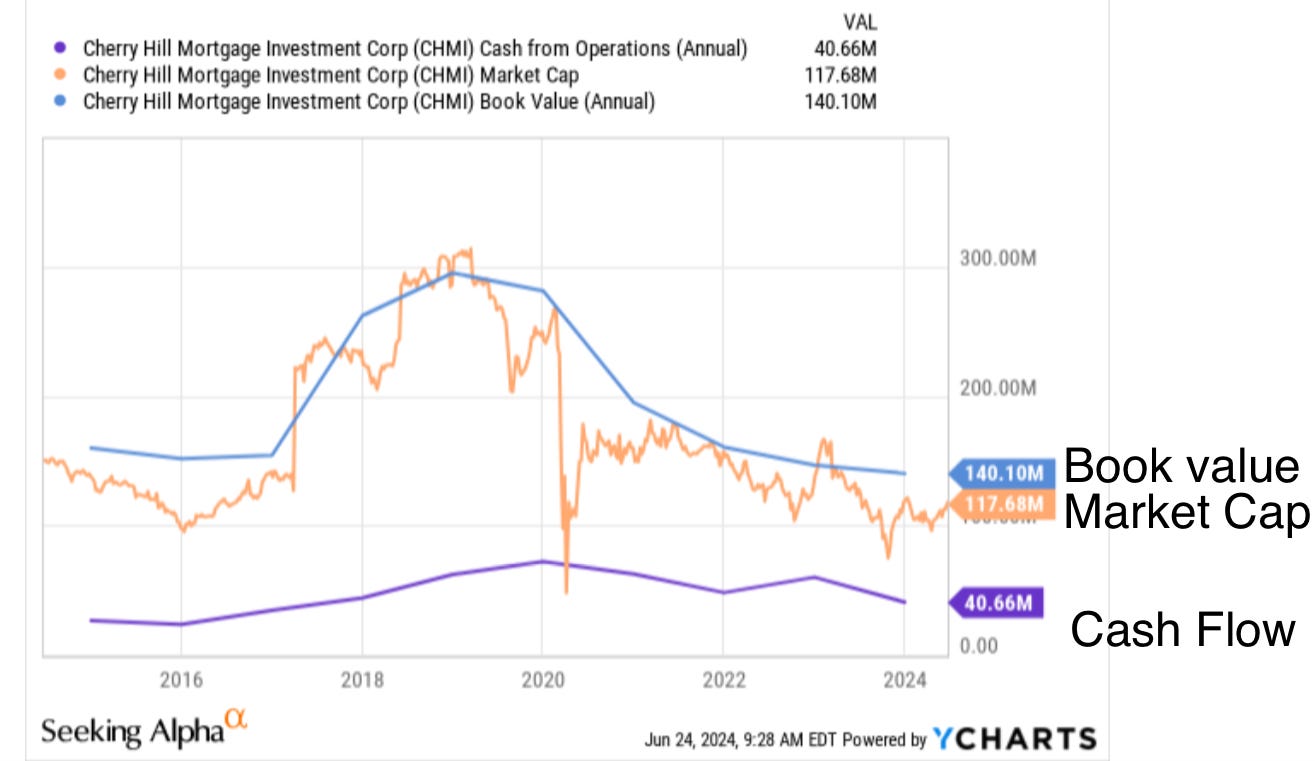

CHMI

Cherry Hill Mortgage:

Cherry Hill Mortgage Investment Corporation, a residential real estate finance company, acquires, invests in, and manages residential mortgage assets in the United States. The company operates through Investments in RMBS, Investments in Servicing Related Assets, and All Other segments. It manages a portfolio of servicing related assets and residential mortgage-backed securities (RMBS). The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Cherry Hill Mortgage Investment Corporation was incorporated in 2012 and is based in Farmingdale, New Jersey.

Discount to book value. In an extremely out of favor group. Significant dividend while you wait for a recovery.

Shares can be purchased now. Use a 10% sell stop as always.

Insider buying is always an added plus.

$ QRTEA Qurate

About the Company

Qurate Retail, Inc. is a Fortune 500 company comprised of six leading retail brands – QVC®, HSN®, Ballard Designs®, Frontgate®, Garnet Hill®and Grandin Road® (collectively, “Qurate Retail GroupSM”). Qurate Retail Group is the largest player in video commerce (“vCommerce”), which includes video-driven shopping across linear TV, ecommerce sites, digital streaming and social platforms.

The retailer reaches more than 200 million homes worldwide via 14 television channels, which are widely available on cable/satellite TV, free over-the-air TV, and digital livestreaming TV. The retailer also reaches millions of customers via its QVC+ and HSN+ streaming experience, websites, mobile apps, social pages, print catalogs, and in-store destinations. Qurate Retail, Inc. also holds various minority interests.

This is a spinoff from the John Malone empire.

It has not yet entered an uptrend. And it is a bit more speculative, since it has more leverage than companies I typically recommend.

Having said that, there is tremendous upside in the shares at this level

The CEO just purchased 100,000 shares in the open market

Keep reading with a 7-day free trial

Subscribe to Micro Cap Stock Gems to keep reading this post and get 7 days of free access to the full post archives.